Has the lack of finance grounded those international dream vacations you’ve been planning…not going to happen any time soon. Those long and lazy weeks on the beach? Um, not those either. So why not take this downtime to drop some cash into your bucket list trip bank with these tips on how to save for your vacation?

This post may contain affiliate links. If you click through and buy, TravelingInHeels will get a small commission. Thank you for your support!

Tips on How to Save for Your Vacation

Table of Contents

While the vacation bucket list gets longer, your bank account keeps you grounded. Turn your situation into one positive. Really! Use this time to save up for the next adventure. Maybe you’re working from home, or perhaps you’re furloughed right now, but regardless, saving hundreds (even thousands) of dollars when you can’t spend it is a gift, right?!

Adventure looks different for everyone. Whether you want to ski down the mountains in Italy or you want to kick back and relax in a water villa in the Maldives, you need savings for all these vacations.

The best way to save money is to have the spare cash to do it, and that requires a level of financial freedom that most people aren’t able to achieve any time soon.

It’s time to get your finances in order and line your pockets with funds for your next big adventure.

Yes, your financial situation may have slowed you down, but noting can stop you from dreaming of your next vacation! So, let’s take a look at some of the most effective ways on how to save for your vacation.

Budgeting Tips

Since I read and then followed Dave Ramsey’s Total Money Makeover, I’ve now paid off 100 percent of my debt, and created a much healthier savings account and spending habits. I can’t recommend his processes enough.

Read these Budgeting Tips: Ideas for saving money

Start House-Sitting

If you’ve got spare time, house-sitting could earn you a good chunk of cash! While not as many folks are taking long-haul vacations, some still need their homes looked after.

You could also add pet-sitting to this box, as those who travel (whether for business or pleasure) might need someone to watch their pets. Some even offer an opportunity for room and board in exchange for house-sitting. That could potentially save a lot of money in a short space of time on utilities, internet, cable/television.

Simply Stop Spending

Yes, it’s tempting to order everything you see on Amazon, but don’t do it. You may be at home and working, but you don’t need to shop online for every little thing. Prioritize your needs against your wants. Keep your eye on your future vacation — instead of purchasing that pair of shoes, you can’t even wear out of the house. Always give yourself three days to reconsider whether you need something before you buy it.

Open A New Savings Account

Opening a separate account not connected to your smartphone (and perhaps even at another bank) helps you to save and not dip into it. Keep moving money into that account and have it separated from your usual spending accounts. If your company offers auto-deposit, deduct an amount you determine directly into that separate savings account Once you do this, you’ll be surprised how quickly your savings add up.

Also, some banks offer round-up savings that automatically go to your savings.

Invest Your Spare Change – Virtually

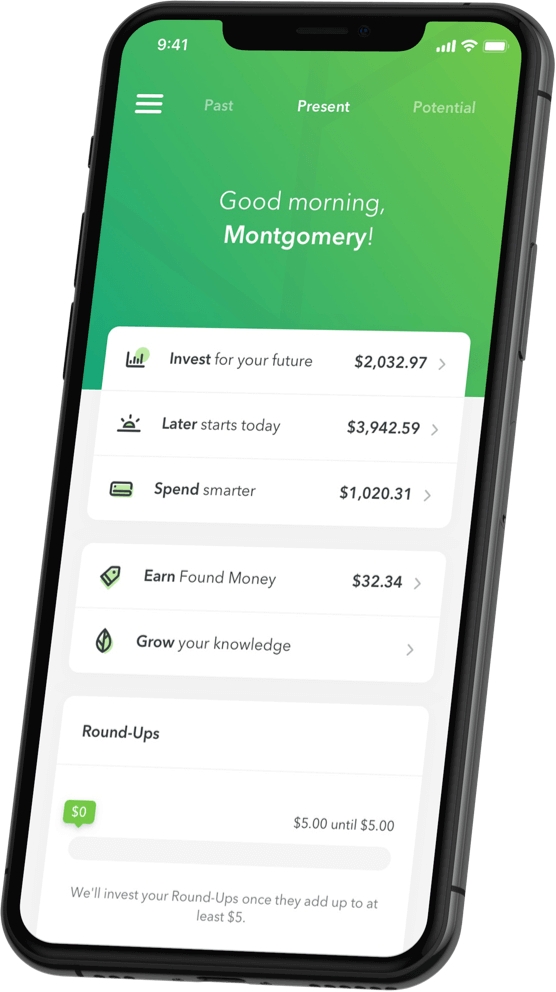

What if there were a way to automate the saving process, so much so that you don’t even notice it!? Well, there is. For the last couple of years, I’ve used Acorns, recognized as the original round-up — and it has quickly become my little “emergency” nest egg.

The mobile app rounds up each debit or credit card purchase (which you choose!) to the nearest dollar, investing those extra pennies in a diversified portfolio of low-cost index ETFs. You have complete access to them online via the app or your computer, but it’s not there in-your-face tempting you to spend! You can also transfer money into your own account at any time.

Use this link to sign up and you receive $5 to invest and so do I! (Thank you!)

Stop Buying Takeout

I know! I love takeout! But seriously, dining out and takeout sucks the budget faster than you can order it. During the pandemic, since we were stuck at home together, hubby and I rarely did takeout, but we do love to cook.

Batch cooking your favorite meals and stocking them in the freezer, then banking the money you save on takeout and coffees is an excellent way to save money. Food really can add up, and you can find that you are spending hundreds of dollars a year on extra food you don’t even need!

Call Your Providers

From the internet to the gas, to your cell phone and cable or satellite, call and speak to your providers to ask if they are offering any discounts. You’re a loyal customer, and you can remind these companies of this and see if you can take your bills down each month. You may be able to create lower payments on pretty much every account, but you need to ask!

We’ve called customer service multiple times on our Dish satellite and our cell phone bill. Each time we were able to save a substantial amount.

Sell Your Stuff

Well, sell the stuff you don’t need or use. Go through the garage and the attic and go through all of your stuff to see what you don’t use. Then, get it listed on eBay or MarketPlace and watch the cash roll in. While it may not sell for what you paid for it, that’s still money in your pocket.

Trying to save for your travels doesn’t have to be stressful, and often when you are looking to go on a vacation or an adventure somewhere new, you can find so many new ways to save money. Traveling the world costs money, and whether you are aiming to go for a few months to see more than one country, or you want to go away for a few weeks, you need to make sure that you’re solvent enough to enjoy it! Getting rid of debt is one thing but having that cash spare for the future and the fun you can have is another.

Share your tips on how to save for your vacation in the comments below! We’d love to hear them.